The newest synonym for money printing in the Fed's ever-expanding Mad Libs book is average inflation targeting. Whereas prior to their August 27 announcement, the Federal Reserve had a hard stop when inflation hit 2.00%. Now the Fed is allowing itself to run "hot" or over 2% for a time until the average is 2%. A single read of inflation over 2% will not trigger a rate hike. What that means for rates is that the 0-25 bps bound Fed Funds is currently constrained by isn't going anywhere for a long time.

Core Personal Consumption Expenditures (PCE) is the Fed's preferred measure of inflation. the last time it was above 2.0% was back in 2018. That year the year-over-year Core PCE was north of 2% 8 out 12 months. Even though more often than not inflation ran above 2% in 2018, the most it ever ran over their arbitrary target was 2.13% in July. The "average" inflation of 2018 looking at the monthly numbers was only 1.993%. Was the Fed wrong to raise rates the 4 times it did, we never really achieved average inflation above 2% that year?

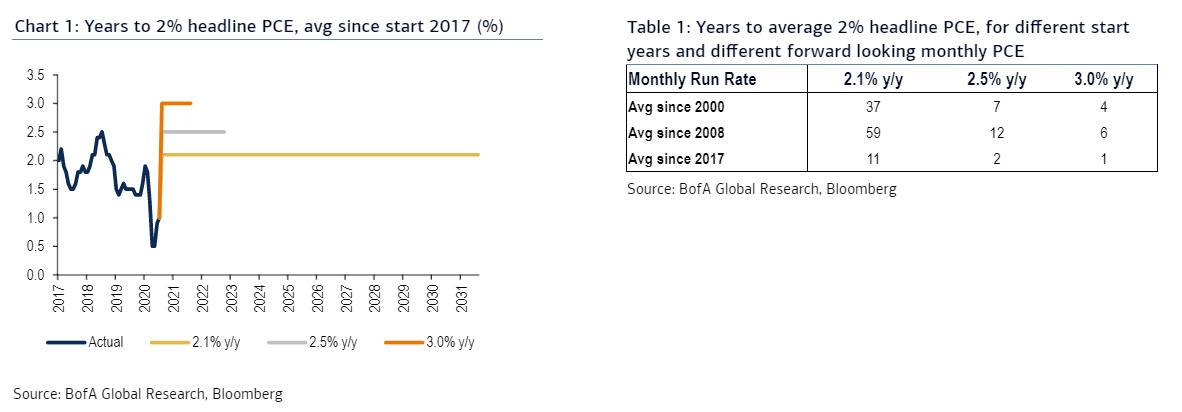

Now what is in an average? Is it the 3 month average between press conference meetings? Average for the year? Average from now on? Looking back a couple years? By some estimates for us to get average inflation above 2% BofA calculates it will take 59 years to achieve this level if we take historical inflation into account!

The fact is we are never going to consistently hit an inflation level that fits the Fed's new guidelines for raising rates. Rates are going to stay low and money is going to stay cheap. The Fed is either naive and doesn't realize how long it will take or is planning on not sticking to these new rules and just not telling us.

All this inflation targeting at the end of the day is pointless if you believe, like me, the Fed's measure for inflation is broken. By other accounts we have been consistently running above 2.0% inflation since monetary policy started wildly printing money. Look at housing prices and the stock market just since the pandemic. Do you really think all the value added in both those markets rational? If the Fed had a better measure accounting for the bubble they help create we'd be raising rates at the next meeting, not years from now. More on broken inflation later...